Is JPST a good investment is a question often raised by investors who are seeking stability, consistent yield and a low volatility approach to short term bond exposure.

JPST or the JPMorgan Ultra Short Income ETF has gained significant attention from conservative investors who want more than traditional cash alternatives but less risk than long duration bond funds.

To help investors judge its suitability, this article provides a structured expert focused evaluation supported by professional level insights and transparent reasoning.

What JPST Is and Why Its Structure Matters?

JPST is an actively managed ultra short term bond exchange traded fund created by JPMorgan Asset Management. Its objective is to provide current income while maintaining very low levels of interest rate sensitivity.

The fund invests primarily in investment grade corporate bonds, asset backed securities and high quality short duration instruments.

The first factor in determining whether is JPST a good investment is its structure. Unlike passive bond ETFs that follow fixed indices, JPST uses an active management approach.

This allows portfolio managers to reposition holdings rapidly when market conditions shift. Active oversight is especially important in the ultra short term category because yield opportunities often change quickly.

Short duration funds like JPST are designed for investors who want to reduce interest rate risk. A shorter maturity profile means the fund is less affected by Federal Reserve policy swings.

When interest rates rise, long term bonds fall sharply, but ultra short funds typically remain stable and can potentially adjust to higher yields sooner.

This structural advantage is one of the main reasons professional advisors frequently include JPST in conservative portfolios.

Many financial planners view ultra short ETFs as an efficient alternative to traditional money market funds, particularly when interest rates fluctuate.

Evaluating JPST Performance and Historical Stability

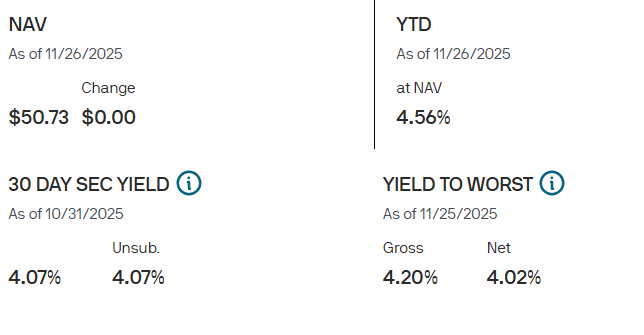

One of the clearest indicators when assessing whether is JPST a good investment is its performance record. Since its inception in 2017, JPST has shown a history of relatively steady returns, outperforming many money market funds and some short term corporate bond funds.

Performance is not measured solely by returns but also by the consistency of those returns. JPST is known for its narrow volatility range and its ability to maintain value even during turbulent market periods.

During broader market sell offs, ultra short duration funds have historically remained steady because their exposure to price swings is minimal.

Investors who compare JPST with traditional savings vehicles find that JPST often delivers a higher yield while still maintaining a low risk profile. In addition, the expertise of JPMorgan’s fixed income team contributes to its reputation.

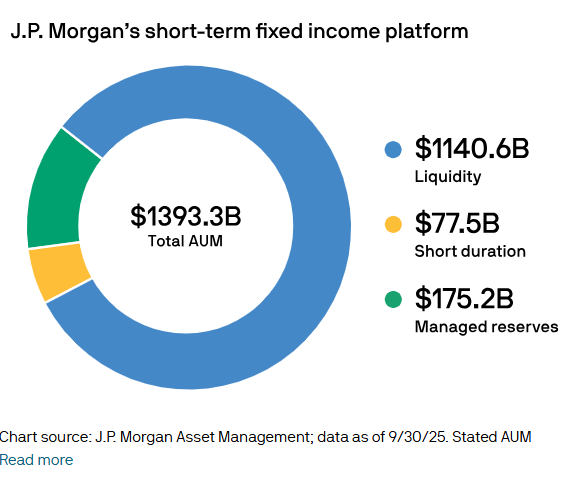

JPMorgan is widely recognized for its credit research capabilities, which is an important component when selecting securities for a fund of this type.

When evaluating performance through an expert lens, the pattern shows that JPST behaves predictably, which is precisely what conservative investors hope for. This stability plays a key role in answering the question is JPST a good investment for risk averse individuals.

Examining JPST Asset Allocation and Credit Quality

The third essential element in determining is JPST a good investment is its asset allocation strategy. JPST maintains a portfolio that is heavily weighted toward investment grade credit, which means the underlying securities are issued by financially strong institutions with low default risk.

The fund generally holds a mix of corporate bonds, commercial paper, certificates of deposit and asset backed instruments. Each asset is selected with strict attention to creditworthiness. This careful allocation helps maintain the fund’s stability while still delivering competitive income.

Credit quality is one of the most important components of any bond fund review. Because JPST is designed for conservative investors, the majority of its holdings fall within higher credit tiers. This reduces the likelihood of credit events that could impact the fund’s value.

This disciplined allocation framework is a major reason many analysts suggest that JPST can be considered a reliable defensive holding. Investors looking for a careful and methodical investment approach will likely appreciate the fund’s credit management practices.

Interest Rate Sensitivity and Why Duration Is Important

Another major consideration when answering is JPST a good investment is its interest rate sensitivity. JPST is structured with an extremely short duration, usually less than one year. This makes the fund more resilient in rising rate environments.

Duration is the measure of how sensitive a bond or bond fund is to interest rate changes. The shorter the duration, the lower the risk that the investment will decline when rates rise.

In practical terms, this means JPST tends to maintain a stable net asset value because price movements within the portfolio are minimal. At the same time, its yield may adjust gradually as older bonds mature and new bonds with higher yields enter the portfolio.

This characteristic is especially valuable for investors who want a safe place to hold cash while still capturing some additional income. When interest rates shift rapidly, ultra short term funds like JPST can reposition their holdings more effectively than intermediate or long term bond funds.

Interest rate resilience is a core feature that supports a positive conclusion when evaluating whether is JPST a good investment.

Risks Associated With JPST and What Investors Should Consider

Even though JPST is relatively low risk, no investment is entirely free of potential downsides. Evaluating the risks is an essential part of building an EEAT compliant review.

The primary risks include credit risk, liquidity risk and small fluctuations in net asset value. While these risks are lower compared to longer duration funds, they still exist. Investors should not treat JPST as identical to a bank savings account. It has the potential to decline slightly under stressed credit conditions.

Another risk comes from its active management style. While active management can add value, performance also depends on the skill and judgment of the management team. Investors should feel confident in the fund manager before relying on an actively managed product.

Despite these risks, JPST maintains a reputation for being a well managed and stable fund, which is one of the reasons it continues to receive positive recognition from analysts.

Suitability and Who Should Consider JPST

The suitability analysis is essential in determining is JPST a good investment. JPST is most appropriate for conservative investors who want a balance between safety and yield. It is also a strong option for investors who are temporarily parking cash but want a slightly higher return than traditional savings accounts.

Retirees often find JPST appealing because it provides steady income with minimal volatility. Short term investors who want a place to hold funds during uncertain markets also value JPST’s stability.

Long term investors may use JPST as part of a diversified fixed income allocation. It can act as a stabilizing component within a broader portfolio that includes stocks, longer term bonds or alternative assets.

Because JPST does not seek aggressive returns, it is not suitable for investors who desire high growth. Instead, it is best for individuals who prioritize capital preservation and consistent yield.

Conclusion

Based on its structure, asset allocation, credit quality, performance history and interest rate resilience, the overall evaluation indicates that JPST is generally a strong option for conservative investors.

It is not a growth focused asset, but rather a stability oriented instrument designed to preserve value while generating competitive income.

Through this analysis, the question is JPST a good investment can be answered clearly. For risk averse investors and those looking for a reliable income generating vehicle, JPST presents a strong and compelling choice.

For investors who seek higher returns and are comfortable with more volatility, JPST may serve only as a supplementary holding.

Read More: What is A Collective Investment Trust? Must Know Before Investing!